Bagley Risk Management : Protecting Your Business Future

Wiki Article

Safeguard Your Livestock With Livestock Risk Security (Lrp) Insurance Coverage

Animals manufacturers encounter a myriad of obstacles, from market volatility to uncertain weather condition problems. In such a vibrant setting, safeguarding your animals ends up being vital. Livestock Danger Protection (LRP) insurance coverage supplies a tactical device for manufacturers to safeguard their investment and mitigate possible monetary dangers. By understanding the ins and outs of LRP insurance coverage, manufacturers can make educated choices that safeguard their livelihoods.

Recognizing Animals Threat Protection (LRP) Insurance

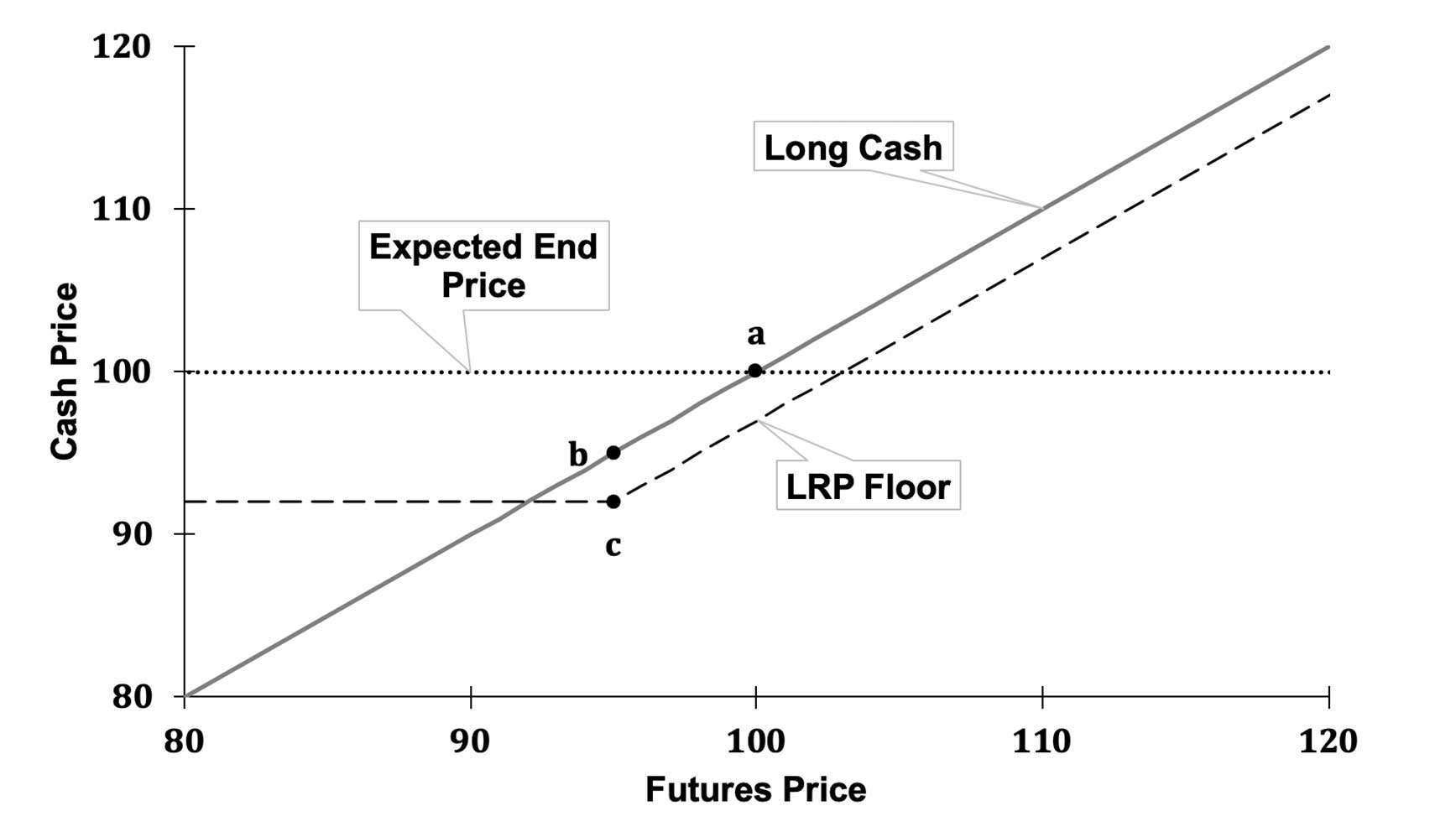

Animals Risk Security (LRP) Insurance coverage offers important protection for animals producers versus potential financial losses due to market rate fluctuations. This type of insurance coverage allows producers to minimize the risk linked with unforeseeable market conditions, making sure a level of monetary safety for their procedures. By utilizing LRP Insurance policy, producers can secure a minimum price for their livestock, protecting against a decrease in market value that could adversely affect their income.LRP Insurance coverage operates by offering coverage for the distinction in between the actual market and the insured price price at the end of the coverage duration. Manufacturers can pick insurance coverage levels and coverage durations that line up with their particular demands and take the chance of tolerance. This adaptability allows manufacturers to customize their insurance policy to ideal secure their economic passions, offering comfort in an inherently unpredictable market.

Understanding the details of LRP Insurance is crucial for livestock manufacturers aiming to safeguard their operations against market unpredictabilities. By leveraging this insurance tool efficiently, producers can browse market changes with confidence, guaranteeing the long-lasting practicality of their animals businesses.

Benefits of LRP Insurance Policy for Animals Producers

Enhancing monetary safety and stability, Animals Danger Security (LRP) Insurance coverage supplies beneficial safeguards versus market rate changes for manufacturers in the animals industry. Among the vital advantages of LRP Insurance policy is that it offers producers with a device to manage the danger associated with unpredictable market value. By permitting producers to establish an assured cost floor for their animals, LRP Insurance coverage helps protect versus possible losses if market rates fall below a particular degree.Furthermore, LRP Insurance makes it possible for producers to make more informed choices concerning their operations. With the guarantee of a minimal rate for their livestock, producers can intend in advance with greater self-confidence, recognizing that they have a security web in position. This can lead to boosted stability in profits and decreased monetary anxiety throughout times of market volatility.

Exactly How LRP Insurance Mitigates Financial Risks

By giving producers with a reputable security web versus market value fluctuations, Livestock Risk Defense (LRP) Insurance properly safeguards their financial security and lessens prospective dangers. One essential way LRP insurance policy aids reduce monetary threats is by providing defense against unexpected declines read the full info here in animals costs. Producers can acquire LRP policies for details weight arrays of animals, enabling them to hedge versus market downturns that could or else result in considerable monetary losses.Moreover, LRP insurance policy provides producers with satisfaction, understanding that they have a predetermined level of price defense. This certainty enables manufacturers to make enlightened decisions concerning their procedures without being unduly affected by uncertain market changes. Furthermore, by reducing the financial unpredictability connected with rate volatility, LRP insurance coverage allows manufacturers to far better prepare for the future, allot resources efficiently, and ultimately enhance their overall monetary strength.

Actions to Secure LRP Insurance Policy Protection

Protecting LRP insurance policy protection entails a collection of simple steps that can give producers with valuable security versus market unpredictabilities. The initial step in obtaining LRP insurance is to speak to an accredited plant insurance representative.As soon as the application is submitted, manufacturers will need to pay a costs based on the protection level and variety of head insured. It is important to examine and recognize the plan completely prior to making any type of payments to guarantee it fulfills the details needs of the procedure. Bagley Risk Management. After the premium is paid, manufacturers will receive a certification of insurance coverage, recording their coverage

Throughout the coverage duration, manufacturers need to maintain in-depth documents of their livestock supply and market value. In case of a price decrease, manufacturers can sue with their insurance coverage representative to obtain payment for the difference in between the insured cost and the marketplace rate. By adhering to these steps, producers can protect their livestock procedure versus monetary losses triggered by market variations.

Optimizing Value From LRP Insurance

To remove the complete gain from Livestock Threat Security Insurance, manufacturers must purposefully utilize the coverage alternatives readily available to them. Taking full advantage of the value from LRP insurance entails a detailed understanding of the policy functions and making educated choices. One crucial technique is to very carefully examine the coverage degrees and duration that finest align with the particular requirements and risks of the livestock procedure. Producers must additionally regularly examine and change their coverage as market problems and danger variables evolve.Additionally, manufacturers can improve the worth of LRP insurance by leveraging complementary risk monitoring tools such as futures and choices agreements. By branching out view it now risk administration approaches, manufacturers can mitigate potential losses better. It is important to stay informed about market trends, read review government programs, and industry developments that could impact livestock prices and risk management strategies.

Inevitably, maximizing the worth from LRP insurance policy needs proactive preparation, recurring tracking, and versatility to altering situations. By taking a calculated strategy to run the risk of administration, producers can secure their animals operations and improve their total monetary stability.

Final Thought

Finally, Livestock Threat Protection (LRP) Insurance coverage offers beneficial benefits to livestock manufacturers by mitigating economic risks related to changes in market rates. Bagley Risk Management. By securing LRP insurance coverage, producers can protect their livestock financial investments and potentially raise their earnings. Understanding the advantages and actions to make the most of value from LRP insurance is essential for animals manufacturers to successfully manage dangers and protect their servicesAnimals Danger Protection (LRP) Insurance policy offers crucial protection for livestock producers against possible economic losses due to market cost changes.Enhancing monetary safety and stability, Livestock Risk Defense (LRP) Insurance policy supplies beneficial safeguards versus market cost fluctuations for manufacturers in the livestock industry.By giving manufacturers with a trustworthy safety and security web against market price variations, Animals Risk Protection (LRP) Insurance properly safeguards their monetary stability and decreases potential risks. The initial step in obtaining LRP insurance policy is to call a licensed plant insurance policy agent.In verdict, Livestock Danger Defense (LRP) Insurance policy supplies important advantages to livestock producers by reducing monetary risks associated with variations in market costs.

Report this wiki page